All about Real Estate Reno Nv

All about Real Estate Reno Nv

Blog Article

Real Estate Reno Nv - The Facts

Table of ContentsThe Ultimate Guide To Real Estate Reno NvThe Definitive Guide for Real Estate Reno NvThe Of Real Estate Reno NvAll about Real Estate Reno NvAll about Real Estate Reno NvSome Known Factual Statements About Real Estate Reno Nv

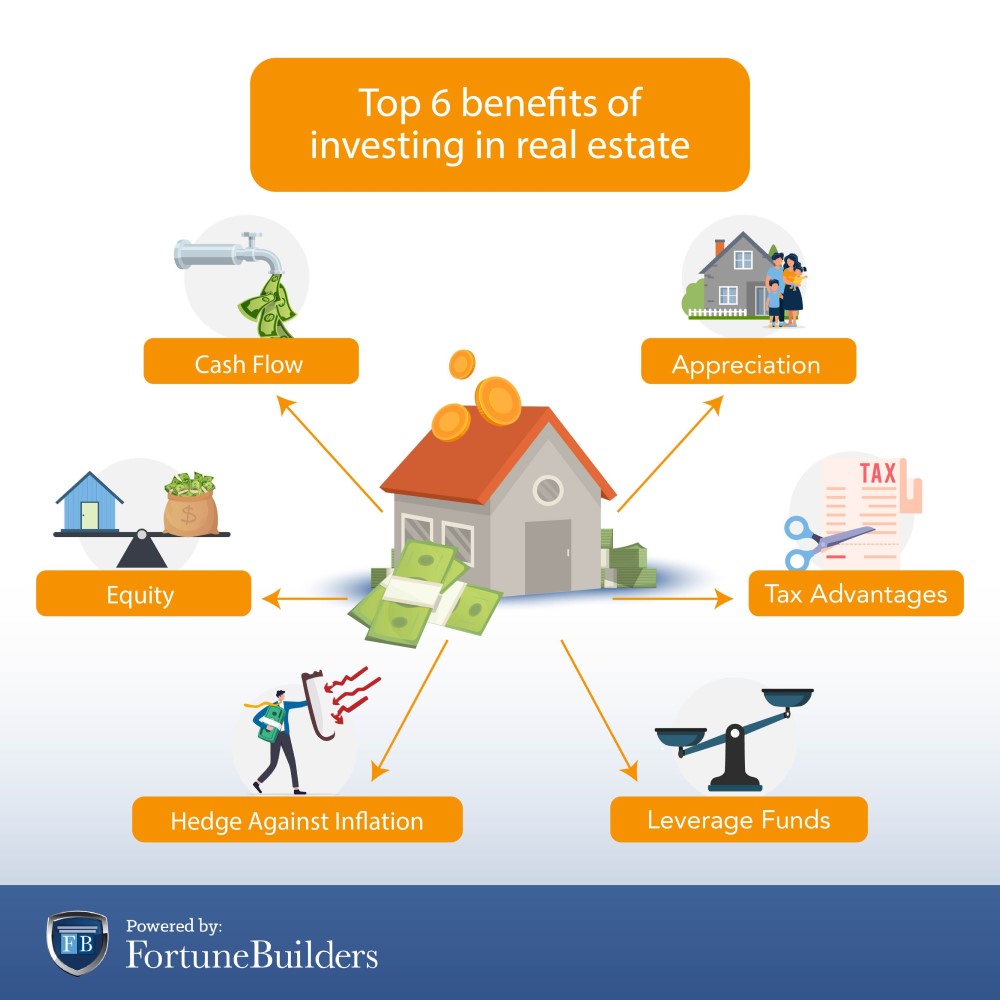

The advantages of investing in genuine estate are countless. Here's what you need to recognize about genuine estate advantages and why actual estate is thought about an excellent financial investment.

The advantages of investing in realty consist of easy earnings, secure capital, tax obligation benefits, diversification, and take advantage of. Genuine estate investment company (REITs) provide a way to invest in actual estate without needing to possess, run, or money buildings. Capital is the take-home pay from an actual estate financial investment after home mortgage repayments and operating expenditures have been made.

Realty worths have a tendency to increase in time, and with a great investment, you can make a profit when it's time to sell. Rents additionally often tend to increase in time, which can cause higher capital. This chart from the Reserve bank of St. Louis reveals average home prices in the united state

Some Known Incorrect Statements About Real Estate Reno Nv

The areas shaded in grey indicate united state economic downturns. Median List Prices of Houses Cost the United States. As you pay down a building home mortgage, you develop equityan property that belongs to your net well worth (Real Estate Reno NV). And as you develop equity, you have the take advantage of to get more residential or commercial properties and increase capital and wide range much more.

Realty has a lowand in some situations negativecorrelation with various other major asset courses. This means the addition of property to a profile of diversified possessions can reduce profile volatility and offer a greater return each of risk. Take advantage of is using various financial instruments or borrowed funding (e.

A Biased View of Real Estate Reno Nv

As economic climates broaden, the need for genuine estate drives rental fees higher. This, subsequently, translates into higher resources values. Real estate tends to maintain the acquiring power of capital by passing some of the inflationary pressure on to tenants and by incorporating some of the inflationary stress in the form of capital admiration.

There are numerous manner ins which owning property can secure against inflation. Building worths may increase higher than the price of inflation, leading to capital gains. Second, rental Find Out More fees on financial investment properties can raise to stay on top of inflation. Ultimately, residential or commercial properties funded with a fixed-rate financing will see the relative amount of the monthly home more info here mortgage payments fall over time-- for example $1,000 a month as a set repayment will certainly end up being much less difficult as inflation wears down the purchasing power of that $1,000.

Regardless of all the advantages of spending in actual estate, there are drawbacks. One of the primary ones is the lack of liquidity (or the family member problem in converting a property right into cash money and cash right into an asset).

The smart Trick of Real Estate Reno Nv That Nobody is Talking About

Yet among the simplest and most common techniques is simply buying a home to rent to others. So why purchase realty? It needs a lot even more job than just clicking a couple of buttons to invest in a mutual fund or supply. The fact is, other there are many real estate benefits that make it such a popular option for skilled investors.

The remainder goes to paying down the finance and structure equity. Equity is the value you have in a property. It's the distinction between what you owe and what the dwelling or land deserves. With time, routine settlements will ultimately leave you having a home free and clear.

The Ultimate Guide To Real Estate Reno Nv

Anybody who's gone shopping or loaded their container recently comprehends just how inflation can ruin the power of hard-earned money. Among one of the most underrated property advantages is that, unlike lots of typical investments, property worth has a tendency to increase, also throughout times of remarkable rising cost of living. Like other important assets, property typically preserves worth and can therefore function as an excellent place to invest while higher prices gnaw the gains of numerous other investments you might have.

Appreciation describes cash made when the total value of a possession increases between the moment you purchase it and the moment you sell it. For real estate, this can mean considerable gains because of the normally high costs of the assets. It's crucial to remember appreciation is a single thing and just gives cash when you sell, not along the means.

As stated earlier, money flow is the cash that comes on a monthly or yearly basis as a result of possessing the residential or commercial property. Generally, this is what's left over after paying all the required expenses like home mortgage repayments, repairs, tax obligations, and insurance. Some homes may have a substantial cash flow, while others may have little or none.

How Real Estate Reno Nv can Save You Time, Stress, and Money.

New capitalists may not really recognize the power of leverage, however those that do open the capacity for big gains on their financial investments. Usually speaking, leverage in investing comes when you can possess or control a larger amount of possessions than you might or else spend for, through the use of credit score.

Report this page